Kreditanstalt für Wiederaufbau, KfW

The Kreditanstalt für Wiederaufbau, (KfW) is a bank for funding energy efficient building, new construction and refurbishment. It subsidizes projects to reduce CO2 emissions and install renewable fuel heating technologies, for instance:

Energy-efficient Construction Programme for everyone who is building or purchasing an energy-efficient home. Loans of EUR 50,000 per housing unit are available at favourable conditions. The better the energy standard, the higher the repayment bonus;

Energy-efficient Refurbishment Programme for everyone who is investing to make an older residential building more energy-efficient or purchasing a newly refurbished home. Either loans and grants are available (the best standard receives the highest support);

KfW Renewable Energies Programme for installing RE plants.

KFW accepts PHPP (Passive House Planning Package) as verification of energy efficient design.

Basic figures

- Promotional bank of the Federal Republic of Germany

- Founded in 1948 as Kreditanstalt für Wiederaufbau to finance reconstruction after World War II

- Shareholders: 80% Federal Republic, 20% federal states

- Headquarters: Frankfurt am Main Branches: Berlin and Bonn

- Representative offices: around 70 offices and representations worldwide

- Balance sheet total at end 2010: EUR 441.8 billion

- Financing volume 2011: EUR 70.4 billion

- Around 4,530 employees (2010)

- Best rating: AAA/Aaa/AAA

Overview

KfW, owned by the German state, is huge, says “Gardian” blogger Damian Carrington (1). It has half a trillion Euros of assets, making it roughly twice the size of the World Bank. It lent €70bn in 2011, raised from international markets at low interest rates thanks to its AAA credit rating. About a third goes to energy and climate change investments, including €24bn from 2009-2011 on energy efficiency in homes, which leveraged a total investment of €58bn. So what has KfW achieved? Since 2001, its loans have helped insulate and seal over 2m homes, employing 200,000 people a year in the process. Since 2006, 156m tonnes of carbon have been saved, equivalent to over a quarter of the UK's total annual emissions. The key is very low interest rates, currently 1-2%. These are delivered via KfW's top credit rating, topped up by further government subsidy of the interest rate. In 2011, the state put in just under €1bn, which KfW turned into €6.5bn in loans, which created a total investment of €18.5bn – that's a 20-fold leverage on the state subsidy. "This programme is self-sustaining," Macioszek, director of KfW, adds. "If the state puts in €1.5bn [to subsidise interest rates] it gets back €3-4bn in tax income on the works. This programme is one of the most important and most successful we have." In the KfW scheme, the higher you aim, the better the deal. For the most efficient homes – Passivhaus standard - you get up to 12.5% of the loan handed back to you. And if you don't like loans, you can get a grant of up to 20% of the cost of the works. It all adds up to a massive commitment to energy efficiency.

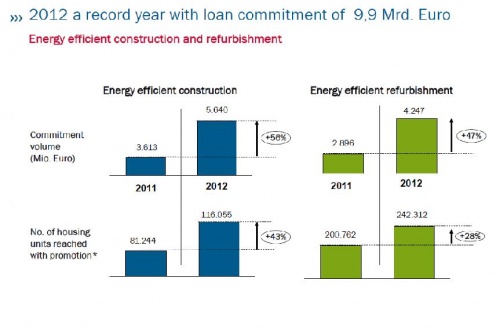

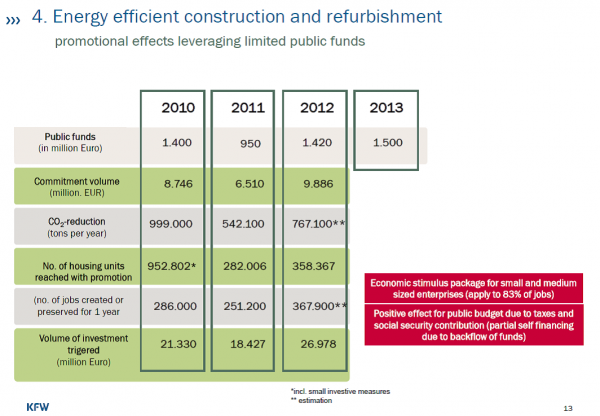

But where did that process start? Taking a look at more recent times, the 1990s saw KfW’s first programmes devised explicitly in support of climate policy.(2) The achievements are impressive. As of 2010, KfW had financed in total the rehabilitation to high energy efficiency standards of 9 million pre-1979 housing units. Between 2006 and 2009 KfW programmes retrofitted 1 million existing homes with energy-efficient products, and approximately 400,000 highly energy-efficient new homes were built, directly generating approximately a quarter of a million jobs per year, largely in the construction and supply chain. Energy efficiency in new buildings has doubled over 2002 - 2009, reducing calculated energy use from 120 kWh/(m2a) to 60 kWh/(m2a), while renovation has reduced it to approximately 80 kWh/(m2a) in existing buildings. It is estimated that every €1 of subsidy has leveraged €9 in loans and private investment, with a leverage ratio of 1:10 for the KfW programmes and 1:12.5 for the Market Incentive Programme (MAP). Moreover, KfW energy-saving programmes from 2006-2009 have saved heating costs of €1 billion per year, resulting in reduced carbon dioxide (CO2) emissions of almost 4 MtCO2/year. CO2 savings through the support programmes (low-interest loans and investment subsidies through KfW and MAP) are estimated at around 1.2 MtCO2 per year. Over the lifetime of the investments, the various measures are estimated to have led to long-term savings of around 72 MtCO2. According to the latest data, 2012 is a record-breaking year for KfW. Commitments amount to 9.9 bln. Euro, which earmarks growth of about 50% compared to 2011 in both energy efficient construction and EE refurbishment.(3)

Energy Efficient construction and refurbishment

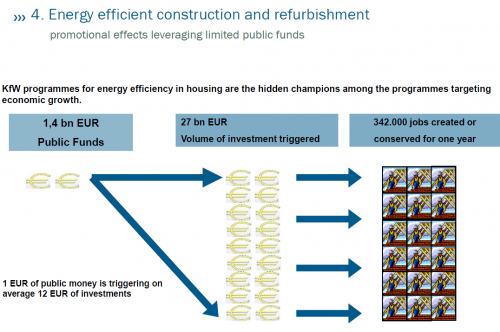

The leverage factor is also higher compared to the analysis cited above: each public Euro invested triggers 12 Euro additional investments. There are also important social benefits as direct outcomes from the programmes.

But what, in reality, is the content of these programmes? What measures are selected, who can benefit and at what circumstances?

Energy efficiency and corporate environmental protection (4)

Financing programmes

'KfW Environmental Protection Programme'

For whom?

• German and non-German enterprises, joint ventures

• Self-employed professionals

• Enterprises under an energy contracting

• Cooperation and operator models (PPP)

For what?

For investments in and outside Germany that contribute to substantially improving the environmental situation. Outside the EU, the share provided by the German partner will be financed.

What promotional funds are available?

• loans to finance investments in general environmental protection measures, usually EUR 10 million per project

What makes this KfW loan so special?

• Up to 3 repayment-free start-up years

• Disbursement 100%

• Particularly favourable interest rates for small enterprises

Loan application: with your bank

KfW Energy Efficiency Programme

For whom?

• German and non-German enterprises , joint ventures

• Self-employed professionals

• Enterprises under an energy contracting

For what?

For investments in and outside Germany that achieve substantial energy-saving effects. Outside the EU, the share provided by the German partner will be financed. Replacement investments must lead to energy end-use savings of at least 20% on the basis of the average consumption of the previous 3 years. New investments must achieve energy savings of at least 15% compared with the industry average.

What promotional funds are available? Loans to finance investments in energy efficiency measures, usually EUR 25 million per project. What makes this KfW loan so special?

• Up to 3 repayment-free start-up years

• Disbursement 100%

• Particularly favourable interest rates for small and medium-sized enterprises

Loan application: with your bank. KfW Energy Turnaround Financing Initiative. For whom? For large commercial enterprises in and outside Germany with an annual group turnover EUR 500 million to EUR 3 billion. For what? For large-scale investment projects in Germany in the areas of energy efficiency, innovative projects in the areas of energy conservation, electricity generation, storage and transmission as well as the use of renewable energies.

What promotional funds are available?

• Direct loans under a banking consortium, with KfW contributing 50% to the financing of the project

• Financing package composed of a loan on-lent through a bank and a syndicated loan with participation by KfW

What makes this KfW loan so special?

• High financing volume

• Disbursement 100%

• Up to 3 repayment-free start-up years

Loan application:

• Direct loan under a bank syndicate: To be filed by the syndicate partner with KfW, no particular form being required

• Financing package:

Application for the on-lent loan: with the applicant's regular bank Application for the syndicated loan: To be filed by the syndicate partner with KfW, no particular form being required

BMU Environmental Innovation Programme For whom? • German and non-German enterprises and other natural persons and legal entities under private law, enterprises in which municipalities are the majority shareholders

• Local and municipal authorities, companies owned and operated by municipal authorities, municipal special-purpose associations

• Other special-purpose associations or institutions incorporated under public law

For what? For the financing of major industrial projects that demonstrate for the first time in what ways advanced technological procedures and combinations of procedures can be put to use to reduce environmental pollution and ecologically sound products can be manufactured and employed.

What promotional funds are available?

Up to 70 % of the financeable costs, no maximum amount. What makes this KfW loan so special?

• Long-term financing at an attractive interest rate

• Interest grant from the BMU to the KfW loan

• In exceptional cases, investment grant of up to 30 % of the financeable costs

• Disbursement 100 %

Loan application: with your bank. Advisory programme. SME Energy Efficiency Advice. For whom? For small and medium-sized enterprises with total annual energy costs of more than EUR 5,000. For what? For initial and/or detailed advice. The advisory services must be provided by an independent energy expert who is accredited for the programme "SME Energy Efficiency Advice".

What promotional funds are available?

• Initial advice: grant of 80% of eligible advisory costs (net fee), up to EUR 1,280.

• Detailed advice: grant of 60% of eligible advisory costs (net fee), up to EUR 4,800. Payments are made directly to your account. Application for the grant: with a regional partner of KfW, e.g. chamber of commerce, chamber of trade, trade promotion society or energy agency in your region. Housing, home modernisation and energy conservation. Energy-efficient Construction. For whom? For everyone who is building or purchasing an energy-efficient home.

What does "energy-efficient" mean?

Energy standards are laid out in the Energy Conservation Ordinance (Energiesparverordnung/EnEV). These standards apply to all new buildings. We finance homes that consume less energy than this ordinance demands. Such energy-efficient homes require innovative heating technology based on renewable energies (such as solar, geothermal, biomass, wood, wind, hydropower) and very good thermal insulation. So they cost more to build than a "normal" new home.

What promotional funds are available?

Loans of EUR 50,000 per housing unit are available at favourable conditions. The better the energy standard, the higher the repayment bonus. Loan application: with your bank. Energy-efficient Refurbishment. For whom? For everyone who is investing to make an older residential building more energy-efficient or purchasing a newly refurbished home Refurbishment into a "KfW Efficiency House" - what does this mean? The energy standards are laid out in the Energy Conservation Ordinance (Energiesparverordnung/EnEV). These standards apply to new buildings. We promote the refurbishment of houses if after refurbishment they do not exceed a specific energy requirement for a comparable new house. KfW has defined five levels of support for a "KfW Efficiency House".

• KfW Efficiency House 55

• KfW Efficiency House 70

• KfW Efficiency House 85

• KfW Efficiency House 100

• KfW Efficiency House 115

• KfW Efficiency House Monument

Simply put, the figures indicate in per cent how much of the maximum primary energy requirement specified by the EnEV the house consumes. The best standard (55) receives the highest support. In order to meet the high energy standard of a KfW Efficiency House, extensive investments such as the renewal of heating systems, thermal insulation and replacement of windows, are usually required.

Individual measures. If the costs and effort of a complete refurbishment would be too high it is also possible to implement only individual measures. Financing is available for

• Thermal insulation of walls, roof and floor space

• Renewal of windows and exterior doors

• Installation/renewal of a ventilation system

• Renewal of the heating system

• Optimisation of heat distribution for existing heating systems

What promotional funds are available? Either a grant or a loan. Grant per housing unit:

• 20.0 % for a KfW Efficiency House 55, not more than EUR 15,000

• 17.5 % for a KfW Efficiency House 70, not more than EUR 13,125

• 15.0 % for a KfW Efficiency House 85, not more than EUR 11,250

• 12.5 % for a KfW Efficiency House 100, not more than EUR 9,375

• 10.0 % for a KfW Efficiency House 115, not more than EUR 7,500

• 10.0 % for a KfW Efficiency House Monument, not more than EUR 7,500

• 7.5 % for the implementation of individual measures, not more than EUR 3,750

The grant is transferred to your account after completion of the refurbishment measures.

Application for grant: with KfW

Loan: up to EUR 75,000 per housing unit for energy-efficient refurbishment plus a repayment bonus calculated on the loan amount.

• 12.5 % for a KfW Efficiency House 55

• 10.0 % for a KfW Efficiency House 70

• 7.5 % for a KfW Efficiency House 85

• 5.0 % for a KfW Efficiency House 100

• 2.5 % for a KfW Efficiency House 115

• 2.5 % for a KfW Efficiency House Monument

The repayment bonus is transferred to your account. This means you have to pay less. Loan: For individual measures up to EUR 50,000 per housing unit Loan application: with your bank Energy-efficient Refurbishment - Construction supervision What promotional loans are available? Grants for professional construction supervision by a technical expert 50 % of the costs for the supervision of construction, maximum of EUR 4,000 Application for the grant: with KfW Age-appropriate Conversion. For whom? For everyone who is remodelling a home to reduce barriers or purchasing a newly converted home.

For what? The programme is good not only for senior citizens. It also benefits persons with limited mobility and families with children. Financing examples include:

• Remodelling to reduce barriers, such as walk-in bathtubs and handles

• The creation of adequate clear space, for example for wheelchair users

What promotional funds are available? For age-appropriate conversion up to EUR 50,000 per housing unit can be financed at favourable interest rates. Loan application: with your bank. KfW Home Ownership Programme. For whom? For everyone who wants to buy or build a house or a home to live in themselves. What are the funds for? Land acquisition and construction costs or purchase price including ancillary costs such as notary public and real estate agent fees, land transfer tax and purchase of cooperative shares to obtain membership of a housing cooperative. What promotional funds are available? Up to EUR 50,000 can be financed with the KfW loan. Funds from this programme may always be applied for additionally to finance the acquisition of owner-occupied housing. Loan application: with your bank.

references:

(2) http://sticerd.lse.ac.uk/dps/case/cp/KfWFullReport.pdf

Practiacal outcomes

First, the German ‘three-pillar’ approach of integrating energy efficiency provisions into a clear framework of regulation, information and support for renewables has served it well, creating a strong, enforceable legal standard to underpin change and generating a clear, consistent message about the direction and required radical nature of change.

Second, KfW provides repayable loans on favourable terms, or performance-linked investment subsidies, rather than unconditional subsidies or tax concessions, as a more reliable and sustainable funding mechanism.

Third, the German schemes provide qualified expert advice and installation so that appropriate work is carried out to a high standard. As a result, the promised energy gains and a positive customer experience have been achieved, and over time the German construction industry has acquired great expertise in this area.

Fourth, German policy requires investments in energy efficiency to be made before subsidies for renewable energy are paid. This increases the proportionate contribution renewable energy can make to meeting overall demand, saves money, makes a bigger contribution to the wider goal of climate protection, and provides a more coherent overall message to the public about the need to reduce CO2 emissions.

Fifth, German policy assumes it is better to adopt a ‘whole house approach’ to energy saving, even if measures are adopted piecemeal, and high energy efficiency measures only implemented bit by bit as people work on different parts of their houses. This enables the overall ambition for energy efficiency improvement to become clear for energy suppliers and builders, while giving some assurance to government that the required emission reductions will be achieved. Sixth, policy aims to support experimentation and innovation, to build awareness and familiarity for new approaches to energy efficiency, and to identify successful approaches that can be taken to scale. Seventh, public buildings have an important role to play, to provide conspicuous examples to the public of what can be achieved by ambitious retrofit measures. This is particularly the case in schools, nurseries and children’s centres, where such measures can have important educational benefits as well. Ultimately, conserving attitudes and behaviour towards energy use, and awareness of the need to reduce greenhouse gas emissions, are going to be required if the necessary step changes in home energy efficiency are to be achieved. There has so far been widespread public support in Germany of the government’s energy saving and green initiatives. This is at least partly because of a perception in Germany that energy saving and climate policy can create energy security and economic benefits for the future. (5)

reference

(5) http://sticerd.lse.ac.uk/dps/case/cp/KfWFullReport.pdf

KfW project in Aspiring region Latvia

More information:

Energieeffizient bauen und sanieren mit der KfW zu besten Konditionen